In January 2014, life was good. I had just graduated with my MBA shortly after completing undergrad in May of 2012. I was running a part-time company that I started in school and I was eager to get out into the workforce to showcase my skills and start making some real cash.

Life was good. I had done what I was supposed to do and I did it well. And I did it right, so I thought.

As my six month student loan grace period came to an end, that euphoric feeling of accomplishment came to a grinding halt when I actually sat down to view my student loan balance and payment schedule.

After tracking down all of my loan service providers – both federal and private, subsidized and unsubsidized – the damage was clear.

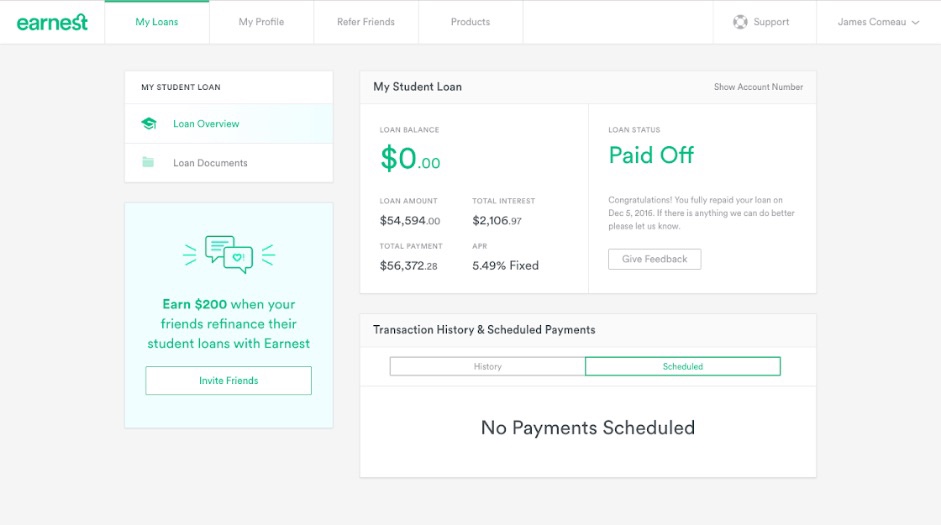

$54,594

Wait, this isn’t really damage, right?

It’s an investment, they said. It will be fun, they said.

Unfortunately, that’s not how I saw it.

Misinformed and misguided — right or wrong — I viewed my student loan balance as a hindrance to my life ahead of me. How could I go on with life and do the things a young 20-something-year-old is supposed to do?

Travel, pursue my entrepreneurial passions, spend time with family, go out with friends on the weekend. In my eyes, this all came to a screeching halt when I realized my student loan balance and the cost (damage) of my monthly payments.

I realized that I needed to take control.

That’s when I decided that I was going to take full control of this situation, develop a strategy to chip away, and take these student loans on at full speed.

Here is my plan that allowed me to pay off $54,494 in 3 years…

1. Dive right in and face the facts

(skip to step 2 if you are already paying your loans)

The earlier the better. If possible, I’d recommend not waiting until the very end of your grace period to figure this out, as your loans may be gaining interest. Some important things to figure out are:

- Whether your loans are public or private

- Who your loan servicer is (could be multiple)

- Total amount owed (principal balance)

- What is the current repayment plan

- Current amount of monthly payment

- Your payoff end date

2. Refinance your student loans

If there is one step in my plan that is a must — it is this one.

After you have a full understanding of the larger picture, it’s essential to look into the option of refinancing your student loans. In a nutshell – refinancing is the simple process of consolidating all of your loans, often containing various different interest rates, into one single loan at a lower interest rate. Refinancing may very well be the best move you make in the student loan repayment process.

There are few major players in the student loan refinancing space and I was fortunate enough to have chosen Earnest. Not only does Earnest consolidate various different loans, but they make it super easy to see your balance, set your payment schedule, change payment amounts on the fly, make additional payments, and see your payment history all in its simple easy-to-use app.

Earnest also uses simple interest versus daily compounded interest – saving its student loan borrowers $30,939 on average (stat taken directly from their site).

To see if you are eligible to refinance your student loans today and get a $200 referral bonus immediately towards your first payment, click here to get started on the application through my referral page.

One of the other reasons I really enjoyed Earnest is because of their customer service. I can recall two or three times I needed to call in for assistance and it was by far the best customer service I have ever received. I actually called back in to thank the guy who helped me. This really sets Earnest apart from any other loan servicer!

3. Cut back on expenses

You’ve probably read about this over and over – but it’s true. Rather than telling you why this is important, I will show you how I did it:

- Netflix: Cut $9.99/per month – see you later House of Cards (but OK to keep if you cut cable altogether).

- Amazon Prime: Cut $12/per month – peace out free 2-day shipping.

- Coffee: Cut $90/per month (calculated $3/day including weekends) – I love you, Starbucks, but will reconvene another day.

- Lunch: Cut $200/per month (calculated $10/day Mon-Fri) – Invest in tupperware and bring on the leftovers.

- Dinner: Cut $100/per month (substituted $300/month ordering out for dinner with $200 worth of monthly groceries) – This was hard to cut back on, but I became WAY more healthy cooking my own food.

- Bars and nights out with friends: Cut $400/per month – This was a huge sacrifice for me, but I was committed to my goal of paying down my student loans and $100 weekend nights at the local pub didn’t fit into my plan.

All-in-all, this cutting back process saved me around $810 each month – most of which I put directly into my loans as an additional payment.

4. Maximize your time by increasing income and side hustle

This part of the plan will be a little different for everyone depending on your desired career. For those going into business, not only is sales a great way to enter the job force, but sales jobs can be highly lucrative.

Sure, there are plenty of crappy ones. But do your homework, network, and find a company with a commission structure that will help you achieve your goals. For me, finding the right employer allowed me to make some beefy additional payments that significantly chipped away at my principal balance.

In addition, seriously consider a side gig. This is especially true for those who don’t have the flexibility to go into sales. I started a private soccer coaching business on the side and held sessions for $60/hour. Every single dollar I made went right back into my student loans.

Some other ideas for side gigs: graphic design, blogging/writing copy for businesses, yoga/spin instructor, personal trainer, coaching is a no-brainer for former athletes, and many others — just be creative. Check out websites like Fiverr and CoachUp for opportunities that fit your lifestyle.

5. Create a payment strategy

Now that your loans have been refinanced and your personal finances are under control (to the best that they can be), it’s time create a strategy that you must discipline yourself to stick to.

First, determine your maximum monthly payment and stick to that as the absolute minimum you pay each month. Don’t pay anything less than the minimum owed. Obviously, if life happens and you need to adjust your payment – the flexibility of Earnest allows you to adjust this or skip a payment.

Next, figure out your repayment schedule and decide your loan’s term. I highly recommend doing a 5 year term. Why? Simply put, the end is in sight.

At the time I joined Earnest, I set my repayment term at 5 years with a $1,040/month payment at a 5.49% interest rate. This was very difficult for me at first, but it was a challenge that allowed me to focus and motivated me to grow my income for extra payments.

Let’s talk about those extra payments.

There are a number of reasons for making extra payments, but first and foremost it means you will be constantly paying down the interest and chipping away at the principal balance. If your loan was gaining $8 daily, that’s $240 that your loan is growing monthly (this is using Earnest’s simple interest calculation as mentioned earlier). Now, if you made an additional payment shortly before or after your scheduled monthly payment, then almost all of that second payment will go towards your principal.

Get extra money? Commit to paying loans.

This is essentially how I paid down that $54,594 balance in three years. Whenever I had the extra money (tax refund, side jobs, gifts, yearly bonuses, etc), I would set up an extra payment within a week or two of my monthly payment. Therefore my $1,040 monthly payment paid off all interest and some, and then my extra payment went straight to the principal.

I’ll never forget my first big bonus for almost $7,000 that significantly reduced my principal. Yes, it was extremely hard to commit and put that amount of cash towards my loans. There were absolutely other things I wanted to spend that money on, but my top priority was paying off my student loans. I can remember being so nervous, but as that payment cleared, watching my balance drop by almost $10,000 in a few months was extremely rewarding and motivating.

6. Measure your success

Now that everything is under control – payments are on autopilot, you are maximizing your income, and extra payments are being made – it is essential to measure your success.

Because Earnest’s app is so user-friendly and simple (apply today to find out your new interest rate), making payments isn’t only easy but it actually gets a little fun. Please don’t blast me for saying that making loan payments is fun, but it’s true. Once things got rolling I thoroughly enjoyed opening my app to set future extra payments and look at the progress I made. It turned into a game for me. It was my motivation.

Can I actually do this?

How fast can I do this?

Imagine what I can do with this money when my loans are gone?

Set monthly or quarterly goals to measure your progress. For me, I measured my student loan repayment success quarterly and also made the decision to put every single commission and bonus check towards my loans. Therefore, I was motivated at my day job to maximize my commission to hit my student loan goals.

Everyone at my job thought I was crazy, but on December 5th, 2016 when I made my last payment and my current balance read $0.00, those around me started asking more questions as to how I did it.

I shared with them my plan and my wonderful experiences with Earnest.

And I started to live.

Like this article? Please share it!

Extra Time Abroad is lifestyle blog focusing on three areas: finance, sustainability, and travel. The blog is managed by husband/wife duo JJ & Janelle. They can be found on Instagram @ExtraTimeAbroad or at the airport!

One thought on “How I Paid off $54,594 of Student Loans in 3 Years”